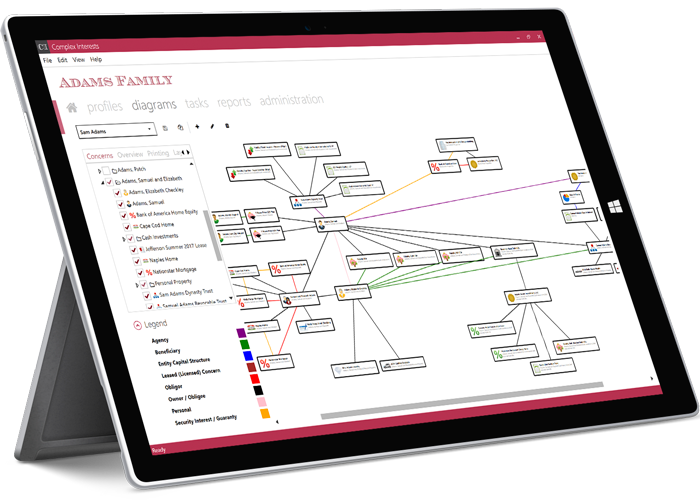

Software for Stewardship of Complex Family Wealth

Who needs family wealth software?

Entrepreneurial Wealth

The family manages one or more operating businesses, typically has commercial real estate in its portfolio to support its business operations, holds passive investments in other related businesses, maintains inter-entity loans and/or guaranties, and collects personal assets of value (e.g., art, automobiles).

Generation Two

The family wealth creator has passed on, and the family's legacy holdings are now managed by the second generation. The wealth creator's children have leveraged the family's assets to create businesses of their own and make investments of interest to them. A robust estate plan exists to benefit the third generation and beyond. Management of the family foundation demands more focus than during generation one.

Liquidity Event

Family wealth was generated through a significant liquidity event and is held in a myriad of trusts for children and grandchildren. The family invests its cash in a diverse portfolio that favors direct and alternative investments. The family likely maintains multiple residences and possibly an aircraft. It is also active in philanthropy through a family foundation.

What does Complex Interests software do?

Learn more about stewardship of family wealth

Who uses family wealth software?

Stewards of complex estates use Complex Interests family wealth software. These users fall into two categories:

- Family Offices, e.g., the wealth creator or a trusted staff person

- Advisors - families without a trusted staff person on the payroll will often nominate an attorney, accountant, or financial advisor to be the steward of the family's estate